How running a lean business model improves your cashflow and efficiency

Keeping your operational expenses under control, while also remaining efficient and meeting customer demand can be a challenge – one that can catch out many new business owners.

This is why running your enterprise using a lean business model is such a good idea. By keeping operations, stock and processes to a minimum, you reduce your outgoings, speed up efficiency and improve your cash position. But how does the lean model work?

5 core elements of a lean business model

In essence, a lean business model aims to eliminate waste in your operational and product manufacturing processes, while still allowing you to meet your customers’ needs.

Originally a methodology that came from the Toyota Motor Company in the 20th century, the aim of lean manufacturing is to cut back the processes to the bare minimum. This helps you streamline the production of goods, cut your operational expenses and still meet the demands of your customers – running the whole organisation in a lean, efficient and profitable manner.

Some core element of a lean model include:

- Cost efficiency – cutting waste is central to the lean methodology. Applying lean allows you to reduce waste in the manufacturing process and minimise any unnecessary spending. This allows you to optimise your resources and allocate funds strategically.

- Increased agility – with a lean approach in place, it’s far easier for the business to be both agile and flexible. This makes it easier to respond quickly to market changes, customer needs and emerging opportunities you spot in your sector.

- Enhanced customer focus – promoting value is another core element of lean. By eliminating non-value-added activities, you can prioritise customer satisfaction and deliver tailored products or services that meet your customers’ exact needs.

- Streamlined processes – lean methodologies streamline your workflows, reduce bottlenecks and enhance your overall operational efficiency. This all leads to improved productivity and shorter lead times, helping you quickly deliver your product to market.

- Sustainable growth – running a lean business model promotes long-term sustainability. There’s a continuous focus on improvement, adaptability and financial stability, all of which helps to make you exceptionally competitive and ready to grow at pace.

Talk to us about implementing a lean strategy

If you want to turn your manufacturing business into a cost-effective, scalable enterprise, moving to a lean business is a big step in the right direction.

Talk to us about your current production and operational strategies. Let’s see how switching to a lean methodology will set you on the path to a more efficient and profitable future.

Get in touch to talk about lean strategies.

Mercer - the latest retail superfund disaster for members

So, here we are again! Back in amongst the conga line of retail superfund disasters which seems to be forever growing.

This time we have a brand new item on the menu of deceit. Mercer (the cook in the kitchen) has served up a stinking dish full of oil companies, alcohol merchants & gambling dens to diners (individual member investors) who ticked the box of being “deeply committed to sustainability”. This dish was labelled as the “sustainable plus option” despite pumping the members invested capital into a crowd of naughty little petrol, piss & ciggy merchants. This practice is apparently so common that it now has its own special name; its called “green washing” which means to falsely claim environmental credentials. ASIC didn’t like it &, on top of slapping Mercer with $140k in fines, has now commenced proceedings in the Federal Court to further lambast the deceitful funds manager.

What would be enlightening to understand is how much additional costs will be incurred in relation to defending and/ or settling/negotiating this matter & more specifically, where the cash will be coming from to pay said additional costs. I’ve highlighted previously the damage done when retail trustees cross subsidise rectification costs https://solveaccounting.com.au/superfunds-where-does-this-cash-come-from/ It seems the unsuspecting & long suffering Mercer members are the next in the long line of retail superfund investors about to get stiffed by their fund managers’ deplorable, misleading & deceptive conduct.

Having studied this & now lived through countless examples of retail superfund disasters, & having paid attention to a Royal Commission on this very topic, I repeat my warnings to everyone about wading into the retail / industry superfund swamp. Specifically, don’t be fooled into thinking that your funds are being used to benefit you. They are most likely being secretly plundered to support a broken corporate bureaucracy which pays lip service to your best interests while extracting the maximum allowable rent possible. Again, to exit this swamp, all retail or industry fund members should seriously consider establishing a low cost, simple self managed superfund.

Call Chris at Solve on 0414 985 724 or email chris@solveaccounting.com.au to discuss your options.

NOTE: the above is NOT personal financial advice. Solve is NOT a financial planner is not holding itself out to be one. Solve Accounting is a low cost, fixed fee for service SMSF administrator which operates wholly within the rules outlined in ASIC info sheet 216.

5 questions to ask when you are buying a business

Purchasing an existing company is a great way to expand your business empire. You can buy out a close competitor, or dip a toe into a new industry and expand your reach as a business group. But whatever the reason for the acquisition, you need to ensure you’re not buying a lemon!

Doing your research is a crucial part of the purchase process. As is asking some probing and insightful questions to help you determine if this acquisition is a good (or bad) idea.

Questions to ask before you make an offer

Buying another company is a major business decision. It’s a large outlay of capital and a big responsibility to take on. If you’re going to take the leap, it’s important to make sure the company in question is stable, well-managed and has a good future ahead of it.

Here are five vital questions to ask before entering into a purchase:

- Why is the business for sale? There are many reasons why an owner might want to offload a company, not all of them good. Their sales may be dropping, they may have rising debts, there may be internal problems with staff or the market for their product/services may be coming to an end. Find out why, so you don't buy a clanger.

- Is this a good industry to step into? Do your research on the industry, competitors, and marketplace that the business currently trades in. It's important that you step into an industry sector that has potential for sales, growth, stable revenues and potential profits. With volatile markets post-pandemic, looking at predictions and forecasts for your chosen industry niche makes good sense and helps you make an informed decision.

- Have you done your due diligence into the business? Do your due diligence to make sure there are no financial, legal or HR skeletons in the cupboard that may jump out to surprise you. Is there an unpaid tax bill? Are there loans that are being defaulted on? Are there any legal cases being brought against the company? Has the business filed all its returns and accounts? As the new owner, any of these issues become your responsibility, so you want to check out the company’s records and history in as much detail as possible. This will prevent some major headaches further down the line.

- Does it have an existing business plan? You'll need a business plan that takes the company forwards and gives you a pathway for your next steps as the owner. Is there a business plan you can use? When was the plan last updated? How well are they tracking against the milestones in that original plan? No business plan is written in stone, so you’ll almost certainly need to review, update and refine this strategy post-acquisition.

- Are your management team and staff up to scratch? When you buy the business, you'll usually also be inheriting the team behind that company. Do you have a management team with the skills, experience and motivation that's needed? Are your employees engaged and do you have a big enough team to meet your own goals for the business? This team will be vital to your future success, so you want the best possible people and talent behind you as you steer a new course for the company.

Talk to us if you’re considering buying a company

Purchasing a company can be a complex and protracted process, even once you’ve completed all your due diligence and background checks. If you’re in the market for a business acquisition, do come and talk to us, so we can help you sort the top deals from the big risks.

We’ll help you complete the relevant checks and will work with you to create a new business plan and strategy that’s designed to turn your new purchase into a business success.

Get in touch to talk through your acquisition plans.

Proving your ongoing business viability through 5 financial reports

Whether you’re applying for government subsidies, taking out a business loan or seeking investor support, you need to be able to demonstrate your ongoing viability as a business.

To prove this viability, it’s important to have the right financial information at your fingertips. This information is also just as important for your own internal planning and decision-making.

So, where do you start and what are the reports that you’ll need?

The numbers that prove you’re a business with a future

Any lender or government body wants to know that your business has a future.

As the owner, you may believe in the destiny of your company, but you also need the numbers to reinforce this argument. Banks, lenders and investors are taking a risk in backing you. Because of this, they want to know that you’re capable of making the agreed repayments, and that the business is in a financial position to deliver profits and payouts for investors.

Before investing in your business, organisations will want to see:

- Evidence of a healthy sales pipeline and sales revenue

- Manageable debt that’s not eating into your capital

- A positive cashflow position that covers your main costs

- Forecasts that show stability or growth in your revenues

- A meaningful business strategy for the next two to five years of growth

The data you need to plan your future

You can’t run a business on a wing and a prayer. With so many different ways to track and record your business data, there’s no excuse for not being up to speed with your performance, your targets and your forecasted sales, cashflow, debt and profits.

This information isn’t just useful when approaching investors and lenders. It’s also vital for your own strategic thinking, your business planning and your internal decision-making

Crucial management information to know will include:

- Your targets and budgets for the upcoming period

- Your sales and financial performance against these targets

- Your basic financial position and health

- Your forecasts for future sales, cashflow and end profits

The 5 key reports that define your company’s growth

Today’s cloud accounting software makes it a breeze to produce detailed and informative financial statements. These are the main statements and reports to focus on:

- Business plan – your business plan is a written document that outlines the company's goals, strategies and financial projections for future success. It’s your route map for the business journey that lies ahead, and a crucial document when approaching investors.

- Sales reports and forecasts – sales reports give a historic summary of your past sales data, so you can track how you’re performing. Sales forecasts project this data forward in time to show future sales trends and potential sales growth you may achieve.

- Revenue forecasts – a revenue forecast is a projection of your expected income or revenue for a specific period. Being able to track and forecast your revenue position is vital information when carrying out financial planning and decision-making.

- Cashflow forecast – a cashflow forecast is an estimate of your expected inflows and outflows of cash over a specific period. By forecasting these cash inflows/outflows you can aim to keep the business in a ‘positive cashflow position (more cash coming in than cash going out).

- Financial statements – the main financial statements to keep your eye on will be your:

- Cashflow statement – shows your current cashflow position, so you can make the most informed decisions about spending and cost management.

- Balance sheet – shows your present assets, liabilities, and equity. It’s a snapshot that reflects the company’s financial position at a specific point in time

- Profit and loss statement (P&L) – a breakdown of the income coming into the business, and the expenditure going out. Crucial for managing your profitability.

- Aged debts – categorises and analyses your outstanding customer invoices, based on when they should have been paid. Keeping on top of this helps to speed up payment and improve your cashflow position.

Talk to us about proving your business viability

Having the data and evidence to prove you’re a viable and stable enterprise is crucial. It’s these numbers that will help you plan your growth and access the investment you need to scale.

We’ll help you create a detailed business plan, revise your strategy and produce all the financial and non-financial statements you’ll need to make informed business decisions.

As your adviser, we’re in the best possible position to provide your management information.

Get in touch to talk about your financial reporting.

5 challenges for small business - and how to beat them!

Founding, building and growing your own small business is a hugely rewarding experience for many entrepreneurs. But the road ahead isn't always smooth.

There are common challenges that crop up and ongoing issues that need to be factored into your business plan, your strategy and your own personal thinking.

So, what can you do to beat these challenges and make the journey as frictionless as possible?

5 proactive ways to overcome your business challenges

We’d all love to know what lies around the corner when it comes to the future path of your business. The truth is that every business journey is unique. But there are common challenges that every owner-manager or CEO will be faced with – and being prepared for these hurdles is the best way to leap over them and take each challenge in your stride.

We’ve highlighted five common challenges and the simple ways to overcome them:

- Uncertainty: No-one has a crystal ball to know exactly what's coming around the corner. But there are ways to be prepared for some unknown circumstances. You can't fully predict the main external threats like government policy, economic conditions or freak weather conditions. But you CAN use forecasting and scenario-planning tools to build up contingency plans so you have a Plan A, Plan B and even a Plan C. With forecasts of your business data, finances and industry trends, you can be ready to react, pivot and take positive action.

- Competition: Small businesses often face stiff competition from larger, more established companies. To stay ahead of the curve, it's important to be nimble and agile. It's also vital to find your niche and to know precisely why your customers value your offering. By ploughing a unique furrow and keeping your customers happy, you can give yourself an edge over larger, slower-moving corporate-size competitors.

- Access to capital: It can be a struggle to secure funding as a startup, particularly if you have limited financial resources or a poor credit history. Having a detailed funding strategy is a crucial way to overcome this problem. Keep your finances in order and make sure you have in-depth financial reports to show banks, lenders and investors. It's also helpful to focus on paying suppliers on time, keeping debt levels under control and ensuring your cashflow is in a positive position. These are all excellent ways to improve your business credit rating and show you're a stable, risk-free prospect for lenders.

- Hiring and retaining employees: Attracting and retaining talented employees is difficult, especially during the ongoing talent shortage. Offering competitive salaries or benefits packages can be one way to attract people. But it's also important to think about your brand reputation, your sustainability credentials and your CSR policy – all things that Millenial and Gen Z workers value alongside decent pay and benefits packages. Employees want to be proud of where they work, so make your company a progressive, satisfying and rewarding place to work.

- Keeping up with technology: Business technology is evolving at a rapid pace. It can be daunting keeping up with all the available apps, tools and software solutions that are aimed at your business. The trick is to be informed but selective about the apps you use. Start with the operational and financial needs of the business and look for apps that can automate, improve efficiency or provide improved data and management information. Talk to other business owners and your profressional network to find out what the essential apps are in your industry. And do your research and homework before you choose any software solution to add to your app stack.

Talk to us about being an agile small business

Looking to the horizon for the upcoming pitfalls is essential as an ambitious and informed business owner. As your adviser, we can help you generate the most informative management information, to keep you agile and ready for what lies around the corner.

We’re also on hand to discuss your ongoing strategy, how to react to upcoming risks and the best ways to access capital and manage your company’s finances.

Arrange a meeting and let’s see what the future may bring for your business.

What's the difference between statutory and management accounts?

As a business owner, you know you need to produce accounts – that’s a given. But do you know the difference between statutory accounts and management accounts?

Your statutory and management accounts have two very separate purposes, and producing both kinds is good practice for any business that wants a handle on its numbers.

Let’s take a look at the key differences and why you need these specific kinds of accounting.

1. What are statutory accounts?

Statutory accounts are a legal requirement for any limited company or partnership. They’re the mandatory annual accounts you MUST produce, submit and file as a company. As such, statutory accounts are a regulatory requirement. You and your fellow company directors have a responsibility to ensure that these accounts are filed on time and in full.

Your statutory accounts will usually include a:

- Directors' report – giving an overview of business strategy and performance, key achievements and the company’s overall financial position. It will also cover shareholder information and dividends alongside broader information about the company.

- Profit and loss statement (P&L) – to outline the income coming into the business, and the expenditure going out over the course of the annual period. This is a key indicator of the profitability of the business during the preceding year.

- Balance sheet – to give a snapshot in time of the assets, equity and liabilities in the business. This is an indication of the financial health of the company on the date that the accounts are produced, a useful report for lenders and investors to review.

- Cashflow statement – so you can see your cash inflows and outflows over the course of the period. In an ideal scenario, you want your inflows to outweigh your outflows. This is known as being in a positive cashflow position.

- Notes to the Financial Statements – which contain supplementary details on your accounting policies, significant estimates, disclosures, and other relevant information for a comprehensive understanding of the financial statements.

2. What are management accounts?

Unlike statutory accounts, management accounts are not a mandatory, legal requirement. But producing management accounts is still good practice for any growing business.

Management accounts are produced to keep you and your top team on top of the business. They will generally be a summary of all the most important financial information and will be run every month or every quarter, depending on your business. This mix of numbers, data and metrics is then used to inform your business thinking and your decision-making process.

A regular management information pack will include:

- Sales performance and analysis

- Financial statements (profit and loss, balance sheet, cashflow statements etc)

- Key performance indicators (KPIs) tracking

- Budget versus actual comparisons

- Inventory and stock levels

- Customer and supplier analysis

- Cashflow forecasts for the upcoming period

- Operational metrics re your production and delivery

- Project updates re your main jobs

- Management commentary and insights.

Talk to us about handling all your accounting needs

Having your statutory and management accounts at your fingertips gives you the best possible overview of your company’s past, present and future performance. Filing statutory accounts keeps you compliant with the law, while having deep-dive management accounts gives you the data and evidence for making properly informed business decisions.

We’ll help you produce your statutory accounts and tick all the compliance boxes. And we’ll also generate tailored management accounts to keep you on the ball with your numbers.

Get in touch to talk about your accounts.

Why your accountant is the mentor you didn’t know you needed

A business mentor can provide guidance and support, so you make the right decisions and stay focused on the end goal as a business owner. They can also help you move forward in your career by providing advice and feedback on what steps to take to reach the pinnacle of success.

But have you ever thought of your accountant as a mentor?

Why your accountant is the ideal mentor

Having someone who understands your business journey is incredibly important. You might see an accountant as someone who files your tax returns. But, in fact, we’re experienced business owners, with access to a significant network of other business professionals.

An accountant can be the mentor you didn’t know you needed. No-one knows your business better than us, so we’re perfectly placed to offer you advice, guide your business journey and help you push your skills and capabilities as a business owner.

As a mentor, an accountant will:

- Expand your knowledge as an entrepreneur – as business owners, we have the knowledge and experience to help you move your business forward. And we can work with you to expand your leadership skills, business thinking and entrepreneurial ideas.

- Be a shoulder to lean on – we'll offer 1-2-1 mentoring sessions where we can listen to your unique worries and concerns as a business owner. Having someone on the same page to listen and empathise is vital for your business and your own mental health.

- Guide the important elements of your business – we’ll help you manage and improve your business strategy, planning and decision-making skills. We’ll also provide the management information systems you need to guide your finances and planning.

- Keep your finances on track – we'll show you how to maximise profits, reduce costs, and make better financial decisions. We’ll also help you plan your own personal wealth and tax strategies, so you can achieve your own entrepreneurial goals and lifestyle.

- Introduce you to a broader business network – we work with hundreds of other business owners across a range of industries. This means we can link you up with other entrepreneurs and founders, so you have a network of other like-minded individuals to connect with. This can be vital when brainstorming and benchmarking, or if you need to talk to someone who understands the specific pain points you’re experiencing.

Having someone to guide your business journey can be invaluable. A business owner must grow and evolve along with their business, and having regular mentoring catch-ups is the ideal way to progress, offload your concerns and look for new inspiration.

If you want to grow as an entrepreneur, please come and talk to us about our mentoring services and how we can guide your business future.

Have you got a plan for growth in your business?

Growth doesn’t need to mean more risk, more hours and more headaches.

It may be as simple as identifying where the opportunities for growth are in your business and industry. Once you’ve done this you can establish what you and your team are going to have to do in order to maximise these opportunities, and how you will navigate the likely obstacles.

Here are a couple of tips to get you thinking about growth:

- Do an audit to document your growth over time. Analyse all the information you have to understand how you got to where you are right now. This will help you to plan for future growth.

- Next, put a one page plan together with the big objectives and what you’ll realistically need to do in order to achieve them. (identify the tasks and people)

- Establish some key performance indicators to keep the momentum up and visit these regularly to ensure you’re on track.

As a business owner, you can get bogged down in the demands of day-to-day business. Taking time out of the business can give you some much needed perspective. We can help build your business plan and identify the steps you’ll need to achieve it.

Business growth can be perceived as something scary, but when you have a plan and it’s done right, it can be very motivating and rewarding.

With a bit of planning, the right systems, people and resources, there is tremendous opportunity to grow and scale your business to the next level to hit your growth targets.

We can help you get started.

Avoid ATO’S increased tax penalties – reminders and updates

Announced as part of the 2023–24 Federal budget, increased funding has been provided to the ATO to scrutinise taxpayers who have high-value outstanding debts of over $100,000 and aged debts older than two years where those taxpayers are:

- public and multinational groups with an aggregate turnover of over $10 million, or

- privately owned groups or individuals controlling net wealth of over $5 million.

Increased penalty rates

After a recent increase in January 2023 from $222 to $275, Commonwealth penalty unit rate has witnessed yet another hike from 1 July 2023 and currently sits at $313 per unit. This means that if you fall behind on your tax lodgements you can expect the financial penalties to increase substantially.

Penalties may be levied on late lodgments of returns and reports that include but are not limited to:

- Activity statements

- Income tax returns

- FBT returns

- PAYG withholding annual reports

- Single touch payroll reports

- Annual GST returns and information reports

- Taxable payment annual reports.

With the increased rates now in effect, a small business can expect to pay base penalties for failure-to-lodge returns ranging anywhere between $313 (1 penalty units) to $1,565 (5 penalty units), one unit for every 28 days the lodgement is overdue.

Small business lodgement penalty amnesty

The ATO is encouraging small businesses that have overdue income tax returns, fringe benefits tax returns or business activity statements etc. to take advantage of a lodgement amnesty that will run until 31 December 2023.

Announced in the 2023–24 Budget, the amnesty applies to tax obligations that were originally due between 1 December 2019 and 28 February 2022 and has been available since 1 June 2023.

To be eligible for the amnesty, the small business must be an entity with an aggregated turnover of less than $10 million at the time the original lodgement was due.

Next steps

To avoid being penalised at the revised higher rates for failing to lodge returns and reports, ensure you collate and send us all necessary information well before the lodgement due date so we can complete your lodgements on time.

If you anticipate delays, best practice is to engage with the ATO and tell them your situation. We can assist you with requesting an extension in lodgement due date, applying for remissions or if necessary, taking out a payment plan to pay off your tax debts.

Small businesses can avail the lodgement penalty amnesty and lodge eligible overdue forms before 31 December 2023 and the ATO will automatically remit any associated failure-to-lodge penalties.

Other matters

Should you have any queries in relation to this matter, please feel free to contact our office.

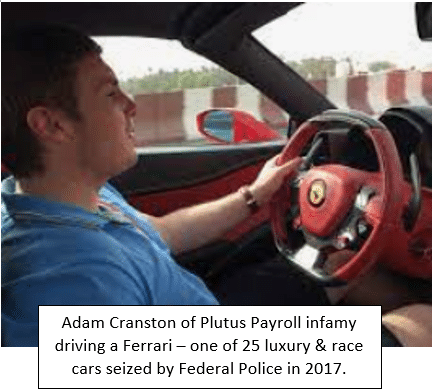

One Ferrari Poorer

Something struck me recently in relation to Ferraris.

I went to school with a bloke who ended up a technician for Ferrari in Sydney. We recently had a beer in Surry Hills together & it was an absolute pleasure to re-connect & press the flesh for the first time in many years. He had some super interesting stories to tell and it got me thinking; why would anyone actually want to buy a Ferrari?

My conclusion; luxury car buyers view their own conspicuous consumption as signalling to others that they have so much wealth they can afford to waste it by driving an unnecessarily expensive car. That may or may not be true, they may just love the vehicle, but regardless, inviting that type of attention is at best not smart & in some cases, flat out dangerous.

I’ll invoke Buffet to prove my point here. Warren would be by far the richest person alive had he not been busy giving away massive chunks of his Berkshire stockholding wealth over the past 2 decades & not claiming tax deductions for doing so (worth stopping & thinking about that!) He drives a Cadillac DTS. He does this because he owns a significant amount of GM shares – same reason I shop at Woolworths, Coles or Bunnings when possible.

Envy is a terrible waste of time, particularly in this case, and I’m going to share with you why. Specifically, what we should all be doing is thanking the luxury car drivers of Australia (& the world) for volunteering to pay the luxury car tax, hideous insurance premiums & significant fuel excise that the rest of us are either unable or unwilling to pay. Their consumption of luxury vehicles benefits all of society & they are willing to both induce & accept serious personal security risks & insurance costs to do so. Specifically, by advertising their lifestyle to the world at large, they are inviting scrutiny not only from would be car thieves & protesters on the street, but also tax authorities who may be interested in understanding which entity owns the vehicle, how much income has been declared by that entity for the past few years, is that entity up to date with its tax return lodgements, is the vehicle on balance sheet, was any GST input tax credit claimed on the purchase & if so on what basis, has the car been depreciated for tax & if so is the calculation correct, if the vehicle is held by a private company has it been provided to an employee or a shareholder or associate for private use & if so has FBT and/or division 7A been applied correctly to it’s market value throughout it’s holding period. Is the vehicle part of a pool of assets which have, or may have been, acquired with the undeclared proceeds of crime? Is a net asset betterment assessment warranted in the circumstances? This is not an exhaustive list.

Why anyone would volunteer for this type of risk is completely beyond me given the sheer unreliability of odd ball luxury car brands which typically retail only a relative handful of vehicles worldwide in any given year. This extremely low volume keeps aftersales service, maintenance & repair costs hideously high for the small pool of owners who make the lifestyle choice of embracing conspicuous consumption in a world increasingly hostile to outward signs of excess.

So, next time you witness that Lambo or Mezza fanging it down the high street, respectfully tip your hat & wish the driver good health & long life!