Mercer - the latest retail superfund disaster for members

So, here we are again! Back in amongst the conga line of retail superfund disasters which seems to be forever growing.

This time we have a brand new item on the menu of deceit. Mercer (the cook in the kitchen) has served up a stinking dish full of oil companies, alcohol merchants & gambling dens to diners (individual member investors) who ticked the box of being “deeply committed to sustainability”. This dish was labelled as the “sustainable plus option” despite pumping the members invested capital into a crowd of naughty little petrol, piss & ciggy merchants. This practice is apparently so common that it now has its own special name; its called “green washing” which means to falsely claim environmental credentials. ASIC didn’t like it &, on top of slapping Mercer with $140k in fines, has now commenced proceedings in the Federal Court to further lambast the deceitful funds manager.

What would be enlightening to understand is how much additional costs will be incurred in relation to defending and/ or settling/negotiating this matter & more specifically, where the cash will be coming from to pay said additional costs. I’ve highlighted previously the damage done when retail trustees cross subsidise rectification costs https://solveaccounting.com.au/superfunds-where-does-this-cash-come-from/ It seems the unsuspecting & long suffering Mercer members are the next in the long line of retail superfund investors about to get stiffed by their fund managers’ deplorable, misleading & deceptive conduct.

Having studied this & now lived through countless examples of retail superfund disasters, & having paid attention to a Royal Commission on this very topic, I repeat my warnings to everyone about wading into the retail / industry superfund swamp. Specifically, don’t be fooled into thinking that your funds are being used to benefit you. They are most likely being secretly plundered to support a broken corporate bureaucracy which pays lip service to your best interests while extracting the maximum allowable rent possible. Again, to exit this swamp, all retail or industry fund members should seriously consider establishing a low cost, simple self managed superfund.

Call Chris at Solve on 0414 985 724 or email chris@solveaccounting.com.au to discuss your options.

NOTE: the above is NOT personal financial advice. Solve is NOT a financial planner is not holding itself out to be one. Solve Accounting is a low cost, fixed fee for service SMSF administrator which operates wholly within the rules outlined in ASIC info sheet 216.

One Ferrari Poorer

Something struck me recently in relation to Ferraris.

I went to school with a bloke who ended up a technician for Ferrari in Sydney. We recently had a beer in Surry Hills together & it was an absolute pleasure to re-connect & press the flesh for the first time in many years. He had some super interesting stories to tell and it got me thinking; why would anyone actually want to buy a Ferrari?

My conclusion; luxury car buyers view their own conspicuous consumption as signalling to others that they have so much wealth they can afford to waste it by driving an unnecessarily expensive car. That may or may not be true, they may just love the vehicle, but regardless, inviting that type of attention is at best not smart & in some cases, flat out dangerous.

I’ll invoke Buffet to prove my point here. Warren would be by far the richest person alive had he not been busy giving away massive chunks of his Berkshire stockholding wealth over the past 2 decades & not claiming tax deductions for doing so (worth stopping & thinking about that!) He drives a Cadillac DTS. He does this because he owns a significant amount of GM shares – same reason I shop at Woolworths, Coles or Bunnings when possible.

Envy is a terrible waste of time, particularly in this case, and I’m going to share with you why. Specifically, what we should all be doing is thanking the luxury car drivers of Australia (& the world) for volunteering to pay the luxury car tax, hideous insurance premiums & significant fuel excise that the rest of us are either unable or unwilling to pay. Their consumption of luxury vehicles benefits all of society & they are willing to both induce & accept serious personal security risks & insurance costs to do so. Specifically, by advertising their lifestyle to the world at large, they are inviting scrutiny not only from would be car thieves & protesters on the street, but also tax authorities who may be interested in understanding which entity owns the vehicle, how much income has been declared by that entity for the past few years, is that entity up to date with its tax return lodgements, is the vehicle on balance sheet, was any GST input tax credit claimed on the purchase & if so on what basis, has the car been depreciated for tax & if so is the calculation correct, if the vehicle is held by a private company has it been provided to an employee or a shareholder or associate for private use & if so has FBT and/or division 7A been applied correctly to it’s market value throughout it’s holding period. Is the vehicle part of a pool of assets which have, or may have been, acquired with the undeclared proceeds of crime? Is a net asset betterment assessment warranted in the circumstances? This is not an exhaustive list.

Why anyone would volunteer for this type of risk is completely beyond me given the sheer unreliability of odd ball luxury car brands which typically retail only a relative handful of vehicles worldwide in any given year. This extremely low volume keeps aftersales service, maintenance & repair costs hideously high for the small pool of owners who make the lifestyle choice of embracing conspicuous consumption in a world increasingly hostile to outward signs of excess.

So, next time you witness that Lambo or Mezza fanging it down the high street, respectfully tip your hat & wish the driver good health & long life!

Defined benefit super schemes are bad for members & everyone else

In superannuation land, there’s a really big difference between market linked accumulation accounts & accounts which are called “defined benefit” (DB) plans. I have changed my view recently in relation to DB super plans altogether & feel compelled to discuss why publicly & for the record.

Although the distinction between DB plans & market linked accumulation accounts is very important, an equally important distinction to make is within the DB category itself. Specifically, there’s a massive (& critical) difference between DB plans which offer a guaranteed lifetime pension (DBGLP) & DB plans which only pay out a guaranteed lump sum (DBGLS).

Firstly, DBGLP plans pay a % of some closing salary amount to the member for the rest of that members life. In rare instances with some very old schemes, upon the members death, that ongoing lifetime pension guaranteed entitlement transfers to the members spouse for the rest of his or her life. These plans now practically don’t exist apart from some very rare instances. For example, it’s possible that some federal Judges can still enter into these types of super schemes as can some federal politicians and military personnel. However, even in those instances, it’s unlikely that the DBGLP entitlements will transfer to a spouse. As part of it’s investment mandate, the Future Fund is designed (among other things) to pay for these pension liabilities for federal Government employees.

Next, DBGLS plans pay out a guaranteed lump sum dollar amount when the member reaches some milestone. Usually this involves accumulating some set number of points in a scheme which is generally linked to tenure of service in their role i.e. the longer you stay, the more points you’ll accumulate. These plans effectively lock the worker into their job for life. Now, there’s nothing necessarily wrong with that, it promotes all kinds of stability. However, a key drawback that I have personally witnessed in practice is that the worker is tied (or scared into staying in) to a job from (say) 20 to 60 and doesn’t have to spend any energy thinking about or learning how to invest or understanding the market linked super system or investment more generally. Then, at 60, they’re handed a bag of cash and told that its now market linked and they have to take care of it themselves to fund their retirement – right at the point in time when they need certainty and expertise in managing their nest egg. What could possibly go wrong?

This unbelievable DBGLS situation is at best a massive mistake on the part of those who allowed it to develop this way, and at worst a scam on the worker, locking them into a role with fear of losing their DBGLS – which in most cases, they’d be much better off without anyway. New DBGLS plans should be banned immediately by law & careful thought should be given to how best to fairly unwind existing DBGLS plans so as best as possible to not disadvantage the workers who have unfortunately been trapped into them.

As for DBGLP plans, well, these are simply repugnant to the idea of a market-based economy. Be under no mistake, whatever your market is should be the ultimate arbiter and allocator of resources in any and all imaginable scenarios or your economy will end up in serious trouble. DBGLP plans are highly, highly questionable (and objectionable) now that super caps have been implemented. Specifically, how is it fair for any person’s salary to be guaranteed for life (ever)? No one should be protected unconditionally from the vicissitudes of the market by a historical employment agreement lest distortions are introduced which effectively result in welfare for the rich & over privileged. Commuting all DBGLP plans to market linked pensions is absolutely justified and even if it fails, the message will have been sent loud and clear. If we want to have a fair and open economy in Australia, which we should, we need to shine a light on these dark corners of the retirement system which will (unfortunately) live on, at least for a little while longer. Making this change will ensure Australian taxpayers are never called upon to support the retirement lifestyles of ageing government fat cats from yester-year like retired judges, politicians & figureheads. Cronyism is repugnant to everything good – but don’t take my work for it, ask a Russian.

Super compounding: Explaining the 7 income elements of a reinvested dividend

The humble laws of basic arithmetic include the well-known concept of compounding. For Australian tax resident investors, there’s a more complex (and powerful) variant which is at play when they purchase a dividend paying share on the ASX and opt to participate in the dividend reinvestment plan (“DRIP”) of that company. I refer to this variant as “super compounding” and to understand it, we need to break down the 6 income components of a reinvested dividend. NOTE: only the first 2 are subject to income tax:

- Cash component: this is the easiest one to understand and requires no explanation. If and when a company declares a dividend of $1, the shareholders will receive a $1 cash payment for each share they hold.

- Franking credit: this is harder to understand. Franking credits are both statutory income AND tax offsets at the same time. The law is in 207-20 of the 1997 Income Tax Act if you want to give it a read on Austlii. While the shareholder is required to “gross up”, they are also entitled to an equal offset below the tax payable line. What this means is that, where the recipient shareholders marginal rate of income tax is higher than 30% (say 47%), then, the shareholder only pays the “top up tax” to their marginal rate – in this case, the excess 17%. Importantly, where the recipient shareholders marginal rate of income tax is lower than 30% (say 15%), then, the shareholder gets a cash refund for the 15% difference. This last one is particularly relevant to self-managed superfunds & gives rise to one form of tax arbitrage (risk free cash profit from a tax rate differential).

- “Look through earnings” / retained earnings: so, for example, the Australian big 4 banks only typically pay out in-between 70-80% of their cash profits generated. This is called their “payout ratio”. The remaining 25 cents is reinvested internally to increase moat and hopefully leads to higher real dividends in the future.

- Brokerage free allotment: when you participate in a DRIP, generally, there is no brokerage fee for you to be allotted the additional shares under the terms of the plan. This is a bigger benefit than it sounds like because just like returns compound over time, so do costs. And this benefit gets bigger as a shareholders position in the investee company grows. This is because brokerage fees are typically on a sliding scale hence the more shares you hold, the bigger your zero brokerage benefit becomes over time.

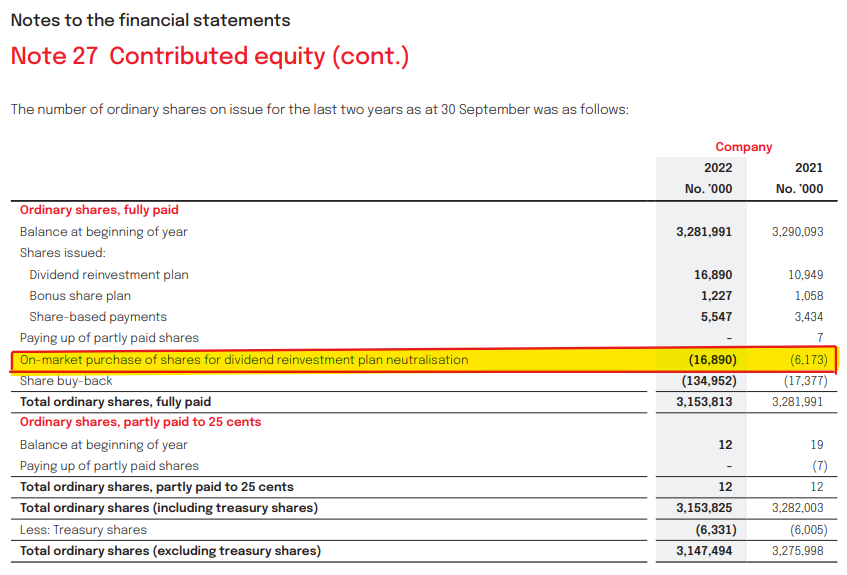

- Treasury concentration: often (but not always) treasury department staff inside your investee company will be actively managing the share register by, for example, ensuring that the company always holds enough shares in itself to satisfy any DRIP allocations which need to occur. Alternately, investees may buy shares on market to neutralize the effect of DRIP allocations. You can see this happening by reading the equity note in your investees annual reports – the NAB one is extracted below. This practice avoids share price erosion which occurs when investees simply issue more shares in themselves to satisfy DRIP allocations ie cutting the same pie into more (smaller) pieces. It also effectively makes each slice of the pie more valuable for the continuing shareholder over time.

- Gain on reinvestment price : the re-investment price (“RIP”) is usually set weeks before allotment. During the RIP window which typically lasts a week, the average price is set by averaging out the closing prices at the close of each trading day. By the time allotment rolls around, the RIP may be significantly less than market price per share. For example, the cash component of a dividend may be $5k, but the shares issued may have a market value of $6K on the allotment date. The unrealised increment in value is not subject to any form of income tax. It is important to note that this can also be a loss, however, for the long term holder, this loss will probably reverse over time, whereas any gain here is a tangible tax free benefit at allotment.

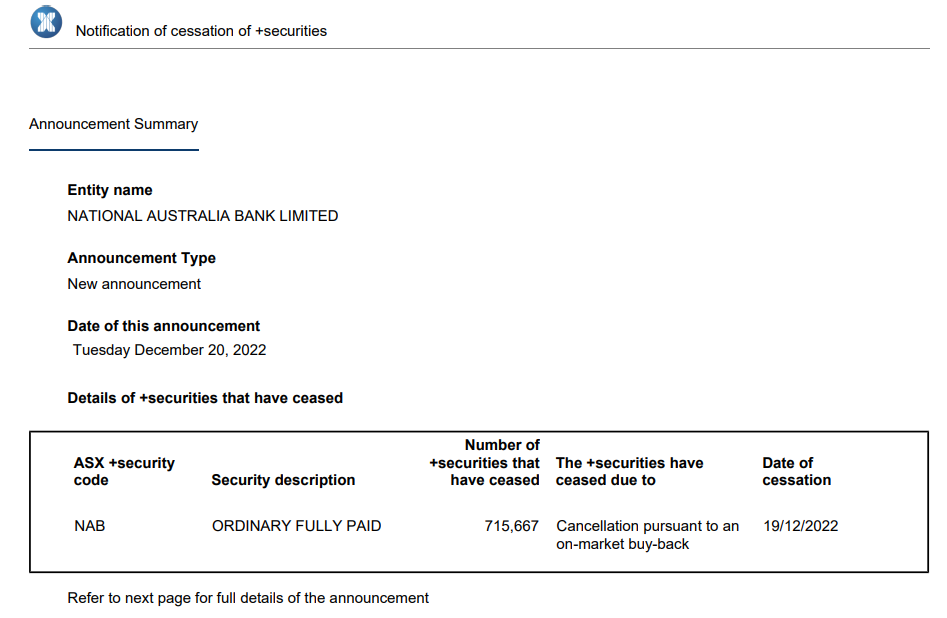

- Slice merging : Aside from treasury concentration, investee companies often will embark upon excess capital management by purchasing shares on market & simply cancelling those shares. Again, NAB did this with $5BN worth of excess capital (read “lazy cash”) in the 22FY. I have extracted one announcement below. This is done for many reasons, but the effect for the continuing shareholder and in particular for the dividend re-investor is to make each share in the company worth a smidgen more as you hold over time. As the number of slices into which the pie is cut decrease, the dividends paid on those shares will proportionately increase as will the share price.

So, there you have it. A summary of why and how dividend reinvestment works to deliver huge value to investors. Australian tax resident investors who do not get involved in this bonanza are acting illogically. This is particularly true in relation to our big banks which form a cartel and mutually reinforce each other’s profitability simply by existing as fail safes for one another. Far from accidental, this situation is in accordance with the Australian Federal Governments unofficial “4 pillars policy” which prevents the 4 from merging. Maybe its anticompetitive. However it has led to decades of stability and has also delivered the extraordinary result whereby our big 4 are among the largest and most stable banks in the whole world despite servicing a domestic population of only 30 million people (including NZ).

To discuss your situation and find out how dividend reinvesting can work for your family group, either inside or outside of super, contact Chris today at chris@solveaccounting.com.au

Avoiding confirmation bias

In recent times the world has witnessed the implosion of FTX. At the same time, Elizabeth Holmes, the once golden girl of tech valley, was sentenced to 11 years in federal prison for securities fraud. Meanwhile, in Eastern Europe, Vlad Putin is busy trying to force a whole sovereign country full of citizens to revert to Soviet style serfdom based on some twisted world view. What do these 3 disasters, along with the legion other examples you might be thinking of, all have in common? Well, as an illustration of my central point in this blog post, I would offer the following “golden thread”; having smoke blown up your arse is insidious and deadly.

Avoiding “arse smoke” and managing those who blow it is an important life skill and guiding principle. In psychology academic speak, it is called avoiding “confirmation bias”. Confirmation bias is the tendency of people and institutions to favour information or explanations which agree with and/or strengthen their existing views & practices. We could add that it also involves the tendency to reject the individuals and ideas who/which challenge, contradict or detract from one’s existing modus operandi. Fighting against it is an idea that should be encouraged to permeate throughout one’s entire life as much as possible. Only by keeping an open mind, asking good questions, and honestly listening to people’s answers can we evolve to a better understanding of the various markets in which we all operate.

In a commercial sense, market validation is the best way to avoid confirmation bias. Replacing “yes men” with honest people is the only way a business or idea or country can progress. Don’t ever believe hype – particularly your own. Always be humble and seek to learn more so that you may grow in knowledge and earnings. Be a constant student of whatever game you are playing and always try to guard against pride and ego. It’s important to remember that things are seldom ever as bad or as good as they seem, and to be measured & calculating in your response to everything. Acting with equanimity, patience and courtesy is the essence of personal quality. We should all strive to be higher quality people.

In that spirit, we should seek out and appreciate contrarians and try to listen to and learn from them. An educated and rational contrarian, one who acts with equanimity, is the ultimate antidote to wishful thinking. Good tax accountants apply their knowledge of the tax law to real world numbers to prospectively guide a client’s decisions to reach tax optimal outcomes. The job of honing and perfecting this skill is lifelong. With humility and a commitment to lifelong learning, a tax accountant becomes more useful to a client with every passing day. The opposite is also true.

To discuss your circumstances, call or email Chris today at chris@solveaccounting.com.au

In the investment universe, simplicity is king.

“Don’t put all your eggs in one basket” – unknown

Having been in the public practice of income tax compliance for close to 20 years now, I’m not so sure about this statement. Diversification belies deep complexity. To understand diversification, we need to define what that means because it means different things in different contexts. Our definition here is purchasing more than one security inside an SMSF. I’ve had to define narrowly here to get through this blog post in a small word count.

Owning multiple shares or assets inside a SMSF is increasingly unnecessary for the “true” investor. One important reason for this is the invention of the low cost, very broad based, computer managed index fund. In Australia, VAS is the leader in this field. Although staff are required to prepare tax statements, the ownership structure of Vanguard funds is circular such that the management company is owned by the fund which aligns unitholders with managers on both stability and cost. Specifically, Vanguard’s management company is ultimately owned by the investors so it will never be acquired and it also allows the manager to return profits to investors through lower costs. In summary, scale up = management fees as a % of assets managed down. This structure creates a self-reinforcing cycle of downward pressure on management costs and it is a welcome financial innovation.

Even putting low cost broad based index funds to the side, diversification is still questionable in a modern and well regulated economy and stock market like the ASX in Australia. Simply buying a share in the CBA for example exposes the shareholder to many different business lines e.g. insurance, super, business lending, project finance, mortgages etc, and the CBA’s revenue streams are also geographically diverse. There’s big non-monetary value in only having to watch one stock. You don’t have to keep track of 20 different holdings and you can accumulate deep understanding of your investee over time. Diversification wears investors down and eventually wears them out. Picking one horse also means that you don’t have to listen to as much twaddle from as many “analysts” shouting over each other to be heard as to what you should or shouldn’t do with your holdings. Picking a big profitable company with a sustainable moat like the CBA or Woolworths or any of the top 10-20 means that its highly unlikely to go bankrupt. The big 4 Aussie banks are oligopolistic monopolies or to put it simply, a cartel (politically protected profit machines). If any of the 4 go broke, the whole country will have much bigger problems than what’s happening to our super balances. In this context what’s wrong with putting all your eggs in one basket?

Advocating for a single holding portfolio is not the point of this blog post. However, it is worth considering for those who understand the value of simplicity in investment.

To discuss your circumstances, call or email Chris today at chris@solveaccounting.com.au

Invest individual, think institutional

“The individual investor should act consistently as an investor and not as a speculator.” – Benjamin Graham

This quote has been attributed to Ben Graham, but I’m not sure if its from TII… regardless, it’s both very true & worth analysis.

There are 4 key definitions in this statement which we need to dig into in order to understand the meaning in this quote:

- Individual. A lot of people think incorrectly about themselves. They perceive themselves as a “human being” as opposed to an institution. While this is correct in the physical universe in which we all live & breathe, in the parallel investment universe, the human / individual is simply another investment vehicle. It can borrow and invest money, hold assets and even run a business as a sole trader. Most people think to themselves “I’m just a small guy, a little fish….” They forget that ultimately, humans own or control everything. Viewing yourself as an investment vehicle expands your thinking about what you can actually achieve financially. Tracking your net worth on a simple Excel spreadsheet and regularly updating it to reflect changes in market conditions is a key financial skill every individual should practice to help them understand and gain insight into, and control of, their financial life.

- Investor. There is no such thing as a long term investor. An investor is a long term thinker & a long term actor by implication. To invest is to not speculate – the terms are mutually exclusive sitting as they do at opposite ends of the spectrum. Investors primarily make money from yield, earnings, dividends, distributions or income from assets. An investor will look to what the asset produces over time to assess its performance and value the asset in the first place. What is also of importance to an investor is the quality of those earnings. Earnings quality is determined by certain characteristics of the asset. In the case of productive land it is location (for rental properties) and output (for farms) that is the key competitive advantage. With shares in companies which derive their value from underlying businesses, it’s the moat surrounding that business in its respective market that is the key competitive advantage. Investors understand competitive advantage of different assets & for the most part will value the asset based on yield before considering the offer price.

- Consistently. The importance of this word cannot be overstated. If there is one personal quality that can lead to investment success, its consistency. Specifically, the consistent buying of high quality assets over time regardless of all market conditions – and dividend or distribution reinvestment if that facility is available. John Bogle was an advocate of this approach particularly with broad based index funds in the investors home currency & market. Home field advantage was a big thing to him. Discipline breeds consistency. Disciplined buying and disciplined re-investment over time can lead to extremely satisfactory investment returns. In Australia, the tax privileged individual who can think & invest in an institutional way is often the most successful type of investor.

- Speculator. A speculator is a person or other entity who seeks to sell something for more than what they paid for it. Speculation is the process which the speculator engages in. Speculation is different to trading. Trading is where the trader purchases items of trading stock (or inventory) to sell in the course of a business he or she or it is carrying on eg . There is nothing wrong with speculation in an open legitimate market. This approach absolutely has its place. Its only dangerous when people confuse speculation with investment. Its also very hard to consistently speculate profitably after fees, costs & taxes are taken into account. Speculative assets typically yield zero as they tend to sit on the other end of the yield-growth spectrum.

Maximising your after tax outcomes from investment or speculation requires timely, accurate & savvy tax advice. To discuss your circumstances, call or email Chris today at chris@solveaccounting.com.au

Attitude, not aptitude determines altitude: Embrace your place and celebrate the ordinary to win

“If you are not willing to risk the usual, you will have to settle for the ordinary.” – Jim Rohn

I strongly disagree with this statement. Specifically, I would counter that the ordinary can produce the extraordinary over time where sound reason is structured into a person’s financial life and bad calls are avoided with discipline. A healthy dose of perspective is also a key trait of successful but “ordinary” people.

There is no reason for the bulk majority of humans to seek anything other than a “normal” life. Particularly those of us fortunate enough to have won the genetic lottery of being born in a developed country with a functioning, legitimate system of public governance. Innovators can’t help themselves – its literally impossible for a true innovator to achieve anything other than superstardom (to the rest of us). To them, Microsoft or Apple or Google or Tesla is normal & usual & the logical, inevitable destination. It is also very interesting that many of the globally significant innovators tend to end up in the United States – as did Terrance Tao. Most of humanity will never be these people, and that’s ok. (a) they are all flawed & human despite their perceived achievement and (b), its not our place in our respective individual family chains to shine that bright – but we can still make our individual links as strong as possible for our split second of consciousness while we’re all passing through by being mindful and responsible custodians.

In direct contrast to the Rohn statement above, Ben Graham has said, “To achieve a satisfactory result is easier than most people realise; & to outperform is harder than it looks.” The Graham statement needs to be understood in context. It alludes to the reality that, no matter how well you go in any field of endeavour, there will always be someone outperforming you & its pointless to chase them. Instead of continually wishing for the grass in somebody else’s paddock, Graham is suggesting that we should each focus on the green patches on our own side of the fence. We should celebrate and nurture them. That attitude represents contentment, which is true success.

Wherever you are, give thanks to whoever your God is for every breath you’re allowed to take. & Whatever you are, be a good one.

118B & income taxing the main residence in Australia - is reform required?

It is clear that the various state, federal and even local governments have their eyes firmly fixed on the last great pool of untaxed assets held in Australia being the approximate $9TN worth of main residences which largely escape any form of taxation. For various reasons which I’ll outline below, the theory is good. BUT, and this is probably the biggest “BUT” in contemporary Australian tax law; no matter how much bureaucratic will there is to implement taxation of main residence assets, the political reality of it is hard…. that’s the last hurdle – political implementation.

Theory is one thing, implementation is entirely another universe. It’s the only roadblock really because the theory behind taxation is correct.

The policy logic reasons FOR taxing the main residence in Australia include:

- Equity – This is a big word. It encompasses a large amount of issues in this context. Just one simple example among many others might be the asset rich but low income “little old lady” living in a $20M Vaucluse mansion. She collects a full aged pension because the main residence is an excluded asset, paying pensioner discounted council and water rates, health care card medical costs, pensioner rate public transport, pensioner vehicle registration costs etc etc then, dies leaving a $30M tax exempt estate comprising solely of her main residence to her already wealthy adult children who have been subsidising her lifestyle in anticipation of the windfall gain. This is not fair, smart or sustainable.

- Flexibility – there’s any number of ways the tax law could be used to ease people into the mindset of taxation on the main residence. Grandfathering in the rules would ensure those who have purchased under the existing regime wont be affected or have many years to contemplate and deal with the impact of the changes. Imposing a lifetime threshold for 118-B CGT exemption equal to the transfer balance cap is another, as is the ability to contribute the proceeds into super in some concessionally taxed way. Such a sweeping reform would touch on many other areas of law, not just tax.

- Innovation – Australia’s taxation system, in fact its whole economic system, is geared towards land ownership. The concessions for main residence ownership and “game playing” are not sustainable, nor are they smart. Policy settings at the moment encourage particularly wealthier people to chase a trophy main residence CGT free windfall. It’s a pity that in Australia, people see homes & land as more of an investment or financial play instead of seeing a house for what it is, a place to live i.e. its either your home or someone else’s. Focusing people’s productive energy on innovation and business risk taking rather than spending most of their productive life paying down a mortgage is a change we should make.

There will be resistance & many counter arguments here as there always is to any reform. The complexities around calculating cost base of a main residence for CGT purposes are an obvious issue that will need to be addressed. Generationally resetting the Australian mindset on land, an inherently non changing and un-innovative asset, is a worthy cause to pursue.

To discuss your circumstances, email chris@solveaccounting.com.au

Year End Tax Planning - 7 things to consider

As humans and other types of tax-payer entities approach 30 June each year, there’s generally a mad scramble to make sure everything that can be done has been done on time to maximise tax refunds or minimise payables. While every client is different, a few summarised themes from our practice in financial year end tax planning discussions are as follows:

- Deferring or bringing forward derivation of income (revenue): if you think or know that you’ll make more or less money next year, then it may make sense to ask your payroll manager to defer any bonus payment to 1 July or not send out your invoices for June work until 1 July.

- Bringing forward or deferring deductions (revenue): you may be a high income individual who has maternity leave coming up. Accordingly, it might be good to pre-pay interest on an investment property mortgage or buy a business depreciating asset before 30 June to take advantage of the instant asset write off rules or the temporary full expensing concessions before they expire.

- Book squaring (capital): if you have carried forward capital losses and are wanting to offset them against current year capital gains, you may choose to “square your book” before 30 June. By triggering A1 gains on sale of assets which have embedded capital gains you can cleanse your tax profile. Alternately, you may want to trigger current year capital losses on some assets and gains on others to offset any CGT payable. It should be noted with caution that wash trading is not book squaring. Wash trades are artificial and result in no material difference in economic exposure to an asset for a taxpayer. While book squaring is legitimate tax planning, wash trading is not and it should not be engaged in.

- Concessional super contributions: this one is tricky but can be super high value. There are heaps of rules around how much a member can contribute and how much of that contribution can be deducted each year. There’s also rules around a 5 year rolling sunset for carried forward concessional headroom that are hard for most taxpayers to understand and will require professional advice to navigate. On top of all the tax law here, there are strict cash receipt rules so, if a taxpayer intends to claim a personal deduction, the trustee of their superfund needs to have physically have received the cash contribution before midnight on 30 June which is easier said than done because sometimes, thanks to delays in a clearning house, contributions can take up to a week to clear.

- Division 83A income: people getting paid in > $1k of shares from their employer need to understand the implications of non-cash assessable income. There are many inter-related tax planning opportunities & pitfalls associated with deriving 83A non-cash income and you should seek professional advice if you are in this position.

- Trust distributions: Trustees need to ensure that beneficiaries are made presently entitled to an identifiable amount of net trust income before midnight on 30 June each year. Generally, trustees should have held planning meetings with their tax accountants in the calendar month of May to decide on how the trust income for the year to date is likely to be distributed at year end. This meeting, along with the distribution decision, should be recorded with a signed minute which is filed for record keeping and future reference. There are complex rules around things called “reimbursement agreements” and how section 100A applies thereto. Trustees should seek professional tax advice.

- ASIC fees are all indexed on July 1st: if you have a private company and are thinking about doing a 10 year advanced payment of the annual company statement fee to ASIC, do so before 30 June to avoid the price increase. This one applies to all ASIC fees capable of being prepaid and taxpayers should seek advice from their registered ASIC agent here.

To discuss your situation and find out if there is anything you should do in the lead up to financial year end, call Chris at Solve on 0414 985 724 or email chris@solveaccounting.com.au