Self Managed Super Funds (SMSF)

Is a SMSF right for you and your family?

WHAT IS A SELF MANAGED SUPER FUND?

A self managed super fund (SMSF) is a private super fund that you manage yourself and are a way to save for your retirement.

The core difference between a self managed super fund and any other type of super fund is that every member (you and/or your family) are considered trustees.

This also means that you are responsible for managing the fund and complying with super and tax laws.

SMSF can take time and money, but can offer long term benefits including huge financial outcomes and savings (see our full list of benefitsbelow). Let Solve Accounting take the stress out of managing this.

Want to find out how easy and simple it us for us to manage your SMSF? You’d be suprised how affordable it is!

1000

WHY SELF MANAGED SUPERFUNDS?

Some of the reasons why Australian's are increasingly wanting to establish SMSF's are listed below:

1. Control: You decide what your super balance is invested into.

2. Visibility: Gives the members P&L & balance sheet visibility.

3. Planning: Forces members to engage with, think about, and take responsibility for their retirement strategy.

4. Royal Commission: Exposed the many dodgy practices and people rife within retail super funds:

5. Low cost: Technological and investment innovations have drastically reduced the cost of operating a SMSF.

6. The Buffet / Bogle effect: Realisation that, in the investment universe, you get what you don’t pay for / the bet – a broad based index will beat an active fund manager after fees, costs, taxes and expenses:

What Does SMSF Accounting Packages Include

At Solve Accounting, our SMSF specialists understand that your requirements are unique, and so are the solutions we offer. Our unique approach allows us to deliver a wide range of self-managed super funds accounting services, depending on your needs. We offer you the flexibility of choosing the SMSF services that best suit your requirements, including;

- SMSF audit services

- Help and tax advice on managing an tax efficient SMSF

- SMSF financial statements and tax returns

- Online reporting and benefit details

What Do SMSF Tax Specialists Do?

Our SMSF specialists provide all the necessary services related to establishing and maintaining an SMSF, including;

- Establishing an SMSF

- Compliance Services

- Taxation and Audit Services

- Tax efficient planning and advice

How to Choose the Right Self-Managed Super Fund Accountants For You?

Australians have several options when saving for retirement. The self-managed super fund (SMSF) is becoming a more popular option as people control their finances. Establishing and maintaining an SMSF is a time-consuming process.

It takes specialist knowledge to know how to handle the money. And that’s where we come to your rescue. At Solve Accounting, you can choose the right self-managed super fund accountants for you.

- Look for Control and Transparency

- What Software Do They Use?

- Robust Support Options

- Fee Schedule

What Do SMSF Tax Specialists Do?

Our SMSF specialists provide all the necessary services related to establishing and maintaining an SMSF, including;

- Establishing an SMSF

- Compliance Services

- Taxation and Audit Services

- Tax efficient planning and advice

How to Choose the Right Self-Managed Super Fund Accountants For You?

Australians have several options when saving for retirement. The self-managed super fund (SMSF) is becoming a more popular option as people control their finances. Establishing and maintaining an SMSF is a time-consuming process.

It takes specialist knowledge to know how to handle the money. And that’s where we come to your rescue. At Solve Accounting, you can choose the right self-managed super fund accountants for you.

- Look for Control and Transparency

- What Software Do They Use?

- Robust Support Options

- Fee Schedule

Why Choose Us?

Getting the tax advice and guidance you need is essential when putting together a self-managed super fund. Solve Accounting provides you with the SMSF services you need to get the most out of your fund. We help with everything from establishing the fund to ensuring compliance with taxes and other regulations.

We offer;

- Fixed-Dollar Fees

- Less Paperwork

- Total Access to Fund Information

If you are too busy to manage your SMSF account or want some help with it, then choose Solve Accounting to manage accounting and tax compliance of a SMSF for you effectively.

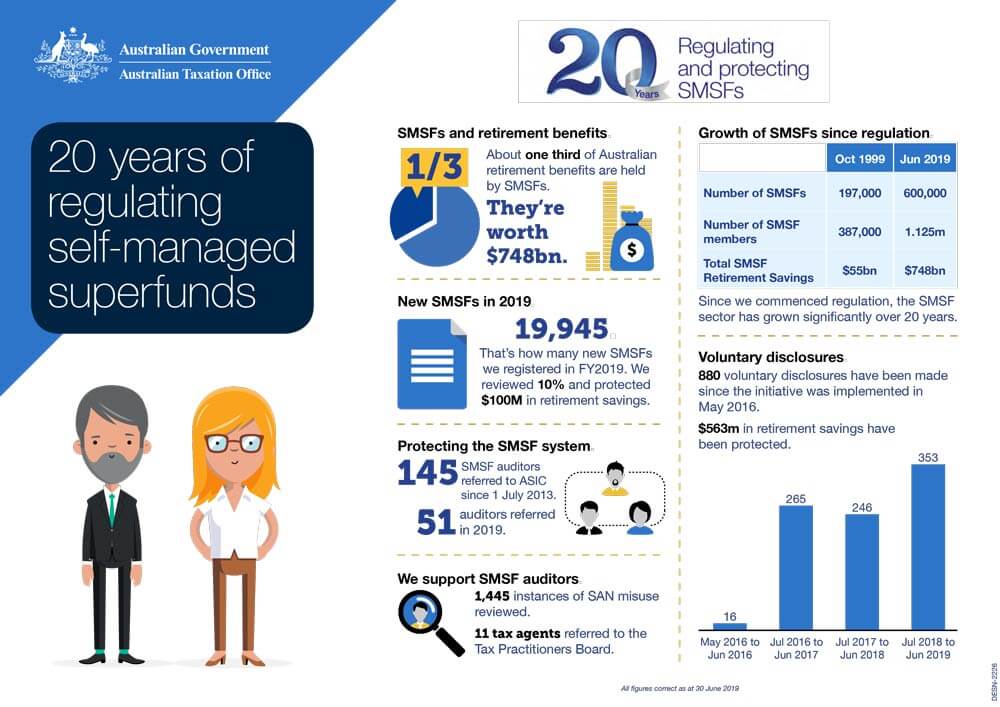

Back in 2019, the ATO ‘celebrated’ 20 years of its SMSF regulatory function in Australia.

In that time the growth of the sector has been significant and this is likely to continue. Back in 2019, SMSF’s held approximately one third of the total superannuation asset pool.

The ATO regulates SMSF and has been doing so for over 20 years. Since the ATO started regulating the sector, it has grown considerably. There are 600,000 funds, with over 20,000 new SMSFs being established every year.

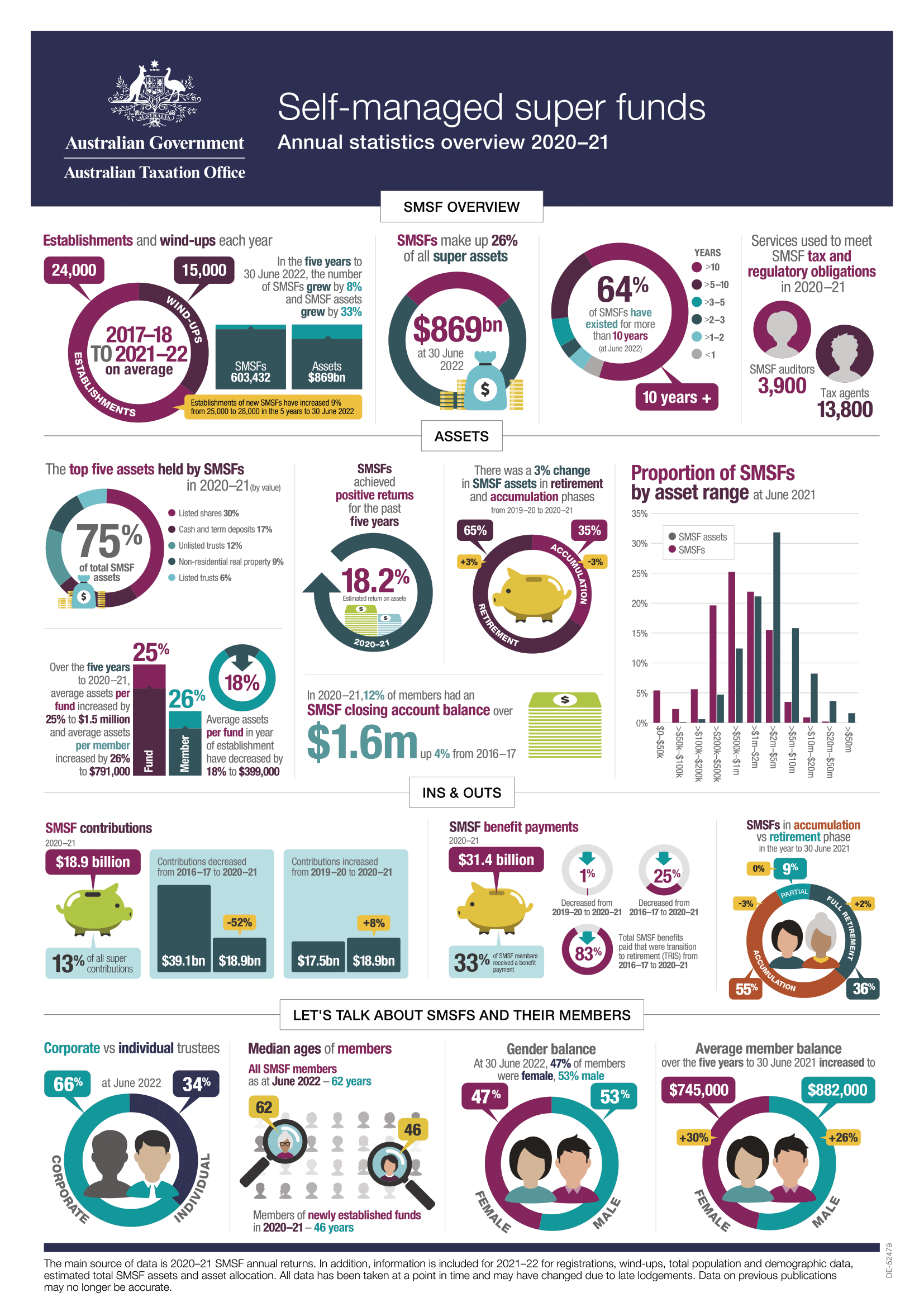

The ATO’s updated SMSF regulatory statistics for 2021 show that the percentage of total super assets sitting inside SMSF’s has slightly declined from a third down to 26%. Interestingly, the number of SMSF’s from 2019 vs 2022 has remained pretty much unchanged at 600,000. This may imply that SMSF trustees found the Covid period difficult to navigate.