Something struck me recently in relation to Ferraris.

I went to school with a bloke who ended up a technician for Ferrari in Sydney. We recently had a beer in Surry Hills together & it was an absolute pleasure to re-connect & press the flesh for the first time in many years. He had some super interesting stories to tell and it got me thinking; why would anyone actually want to buy a Ferrari?

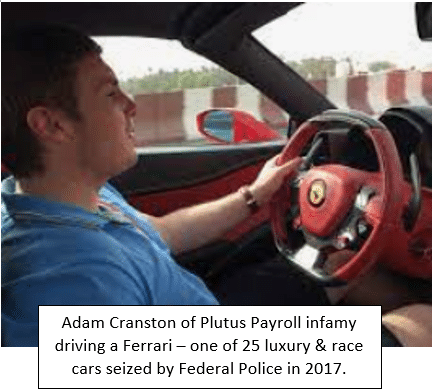

My conclusion; luxury car buyers view their own conspicuous consumption as signalling to others that they have so much wealth they can afford to waste it by driving an unnecessarily expensive car. That may or may not be true, they may just love the vehicle, but regardless, inviting that type of attention is at best not smart & in some cases, flat out dangerous.

I’ll invoke Buffet to prove my point here. Warren would be by far the richest person alive had he not been busy giving away massive chunks of his Berkshire stockholding wealth over the past 2 decades & not claiming tax deductions for doing so (worth stopping & thinking about that!) He drives a Cadillac DTS. He does this because he owns a significant amount of GM shares – same reason I shop at Woolworths, Coles or Bunnings when possible.

Envy is a terrible waste of time, particularly in this case, and I’m going to share with you why. Specifically, what we should all be doing is thanking the luxury car drivers of Australia (& the world) for volunteering to pay the luxury car tax, hideous insurance premiums & significant fuel excise that the rest of us are either unable or unwilling to pay. Their consumption of luxury vehicles benefits all of society & they are willing to both induce & accept serious personal security risks & insurance costs to do so. Specifically, by advertising their lifestyle to the world at large, they are inviting scrutiny not only from would be car thieves & protesters on the street, but also tax authorities who may be interested in understanding which entity owns the vehicle, how much income has been declared by that entity for the past few years, is that entity up to date with its tax return lodgements, is the vehicle on balance sheet, was any GST input tax credit claimed on the purchase & if so on what basis, has the car been depreciated for tax & if so is the calculation correct, if the vehicle is held by a private company has it been provided to an employee or a shareholder or associate for private use & if so has FBT and/or division 7A been applied correctly to it’s market value throughout it’s holding period. Is the vehicle part of a pool of assets which have, or may have been, acquired with the undeclared proceeds of crime? Is a net asset betterment assessment warranted in the circumstances? This is not an exhaustive list.

Why anyone would volunteer for this type of risk is completely beyond me given the sheer unreliability of odd ball luxury car brands which typically retail only a relative handful of vehicles worldwide in any given year. This extremely low volume keeps aftersales service, maintenance & repair costs hideously high for the small pool of owners who make the lifestyle choice of embracing conspicuous consumption in a world increasingly hostile to outward signs of excess.

So, next time you witness that Lambo or Mezza fanging it down the high street, respectfully tip your hat & wish the driver good health & long life!