Wesfarmers released their annual “tax contribution report” today (16.12.21). It’s a useful read for a bloke like me – but most people will be able to carry on with their lives quite comfortably without any knowledge of its existence. Apparently, this is their 6th such report although this is the first one I’ve ever heard of – I’m a bit behind on my reading.

There is one point I want to highlight for the everyday reader here – and possibly also for some tax technical people too.

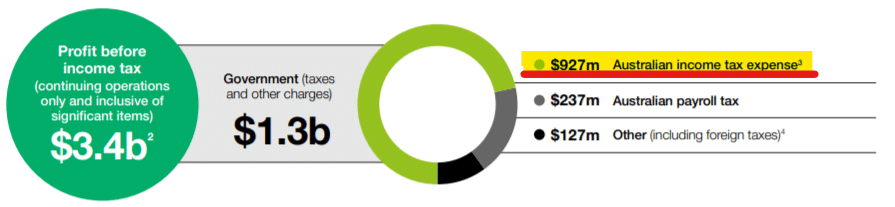

The below graphic is a big picture, heavily rounded summary of some key report numbers:

I’ve highlighted in yellow and underlined in red the number I want to hone in on – the Australian income tax expense. My point here?; the economic contribution of an Australian corporate tax entity (like Wesfarmers) should NOT include Australian income tax payments.

Why? Simple; the imputation system.

Imputation requires by law that every cent of income tax paid by Wesfarmers and all other companies listed on the ASX, and even every private company, is credited against the income tax liability of someone else. That “someone else” is the shareholders of the company. These shareholders may be humans, superfunds or even other companies. They may be residents or non-residents. The point is that the income tax paid by the Australian company is in one way or another a “tax shield” for the shareholders on an ozzy-dollar for ozzy-dollar basis.

Accordingly, at a minimum, this should be explained in a detailed footnote in all “contribution” reports or preferably get its own paragraph explaining the net zero effect of Australian corporate income tax payments. To leave this key detail off along with a detailed reconciliation of the franking account is a deplorable oversight at the very least – but more likely a blatant deception.

To understand how imputation can work for you and your family group, call Chris at Solve on 0414 985 724 or email chris@solveaccounting.com.au