The Secure Jobs and Better Pay Bill - How will it affect your business?

The Secure Jobs and Better Pay Bill 2022 was passed in November 2022 as an amendment to the Fair Work Act 2009.

Some changes start immediately, and others will roll out over the next six months to a year.

The act amends workplace relations laws relating to many aspects of employment. While not every new law will affect every employer, it's essential to understand the extensive changes that are coming.

The Main Changes

- Flexibility of working hours, enabling workers to negotiate hours that suit them.

- Collective enterprise bargaining allows employers within the same industries to negotiate common pay and conditions agreements.

- Changes to the enterprise bargaining system to make it easier for employees to initiate bargaining for an enterprise agreement where existing enterprise agreements have expired.

- Fixed term contract limitations will constrain the number of times a contract can be renewed. This should result in employers offering permanent positions to workers once the contracts have ended.

- Pay secrecy clauses in employment agreements must be removed, meaning an employer cannot force an employee to keep from discussing their pay with colleagues.

- The right to protection from sexual harassment means employers must be proactive in fostering an environment free from sexual harassment.

- Changes to the better off overall test (BOOT) should make assessing whether a proposed agreement passes the test simpler.

- Equal remuneration principles to promote gender pay equality.

What Next?

The Bill has brought significant reforms to employee entitlements that make it more important than ever to ensure your employment agreements comply with the new laws.

There will be more updates next year about the changes, but in the meantime, let us help you prepare for the new laws that will affect your business.

Talk to us about reviewing your human resources documents to ensure you're protected while meeting the new rules required by law.

5 goal-setting tips for 2023

Whether you want to grow your business or take more time for yourself, these goal-setting tips can help you achieve your long-term plans.

- Think big! - What do you want from your life – and how can your business help you achieve that? Think about next year and beyond; what does your business look like in five or 10 years? When you know what end point you’re aiming for, it’s easier to set goals that move you in the right direction.

- Pick something you can measure - Vague goals aren’t as helpful as those you can measure and monitor. Think about what you already measure in your business and how you’d like to see those metrics change. For example:

- A 3% increase in net profit year-on-year

- A 2% reduction in expenses

- 1 new customer per month

- Reduce average payment time to under 50 days

- 4 weeks of holiday during which you don’t go into the office at all

- Make a plan to achieve each goal - Once you’ve picked a few goals, come up with ways to achieve them. It could just be back-of-the-envelope thinking, or have a brainstorming session with your team or your advisers (give us a call!). When you have a plan in place, do your best to follow through and make it happen.

- Keep monitoring your progress - Check in each month to see how you’re tracking with your goals. Set yourself reminders on your calendar or make it part of your invoicing cycle. If you’re not quite on track, you can make tweaks or come up with some fresh ideas to help you reach your targets.

- Plan a celebration! - Give yourself a good reason to keep striving for your goals. It might be a long lunch, a trip to the movies, a manicure, or a beer advent calendar next December. Something you’ll enjoy that’s not going to blow the budget.

We can help

Not sure what your goals should be or how to monitor them? We can show you where to find the information you need, how to check on it, or keep an eye on it for you.

Our team also has some fantastic ideas for how to reach your goals and build your business – get in touch!

Super compounding: Explaining the 7 income elements of a reinvested dividend

The humble laws of basic arithmetic include the well-known concept of compounding. For Australian tax resident investors, there’s a more complex (and powerful) variant which is at play when they purchase a dividend paying share on the ASX and opt to participate in the dividend reinvestment plan (“DRIP”) of that company. I refer to this variant as “super compounding” and to understand it, we need to break down the 6 income components of a reinvested dividend. NOTE: only the first 2 are subject to income tax:

- Cash component: this is the easiest one to understand and requires no explanation. If and when a company declares a dividend of $1, the shareholders will receive a $1 cash payment for each share they hold.

- Franking credit: this is harder to understand. Franking credits are both statutory income AND tax offsets at the same time. The law is in 207-20 of the 1997 Income Tax Act if you want to give it a read on Austlii. While the shareholder is required to “gross up”, they are also entitled to an equal offset below the tax payable line. What this means is that, where the recipient shareholders marginal rate of income tax is higher than 30% (say 47%), then, the shareholder only pays the “top up tax” to their marginal rate – in this case, the excess 17%. Importantly, where the recipient shareholders marginal rate of income tax is lower than 30% (say 15%), then, the shareholder gets a cash refund for the 15% difference. This last one is particularly relevant to self-managed superfunds & gives rise to one form of tax arbitrage (risk free cash profit from a tax rate differential).

- “Look through earnings” / retained earnings: so, for example, the Australian big 4 banks only typically pay out in-between 70-80% of their cash profits generated. This is called their “payout ratio”. The remaining 25 cents is reinvested internally to increase moat and hopefully leads to higher real dividends in the future.

- Brokerage free allotment: when you participate in a DRIP, generally, there is no brokerage fee for you to be allotted the additional shares under the terms of the plan. This is a bigger benefit than it sounds like because just like returns compound over time, so do costs. And this benefit gets bigger as a shareholders position in the investee company grows. This is because brokerage fees are typically on a sliding scale hence the more shares you hold, the bigger your zero brokerage benefit becomes over time.

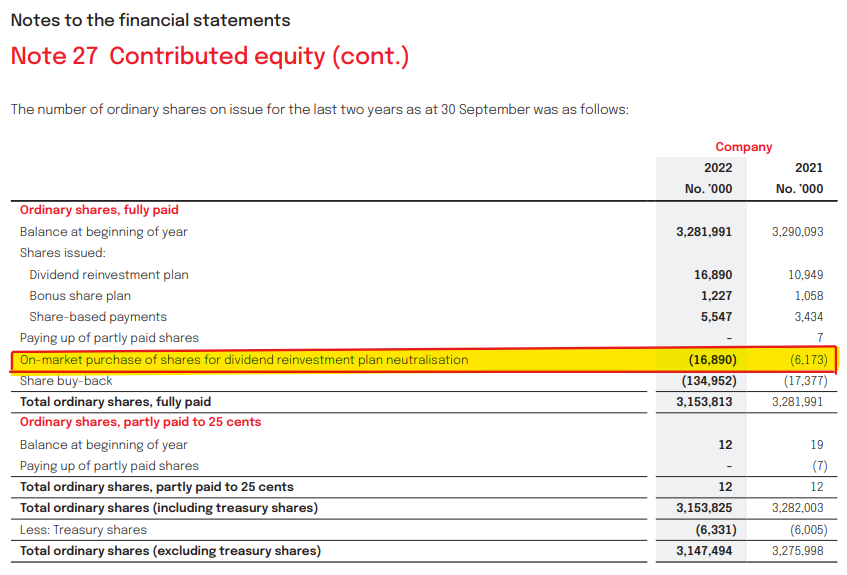

- Treasury concentration: often (but not always) treasury department staff inside your investee company will be actively managing the share register by, for example, ensuring that the company always holds enough shares in itself to satisfy any DRIP allocations which need to occur. Alternately, investees may buy shares on market to neutralize the effect of DRIP allocations. You can see this happening by reading the equity note in your investees annual reports – the NAB one is extracted below. This practice avoids share price erosion which occurs when investees simply issue more shares in themselves to satisfy DRIP allocations ie cutting the same pie into more (smaller) pieces. It also effectively makes each slice of the pie more valuable for the continuing shareholder over time.

- Gain on reinvestment price : the re-investment price (“RIP”) is usually set weeks before allotment. During the RIP window which typically lasts a week, the average price is set by averaging out the closing prices at the close of each trading day. By the time allotment rolls around, the RIP may be significantly less than market price per share. For example, the cash component of a dividend may be $5k, but the shares issued may have a market value of $6K on the allotment date. The unrealised increment in value is not subject to any form of income tax. It is important to note that this can also be a loss, however, for the long term holder, this loss will probably reverse over time, whereas any gain here is a tangible tax free benefit at allotment.

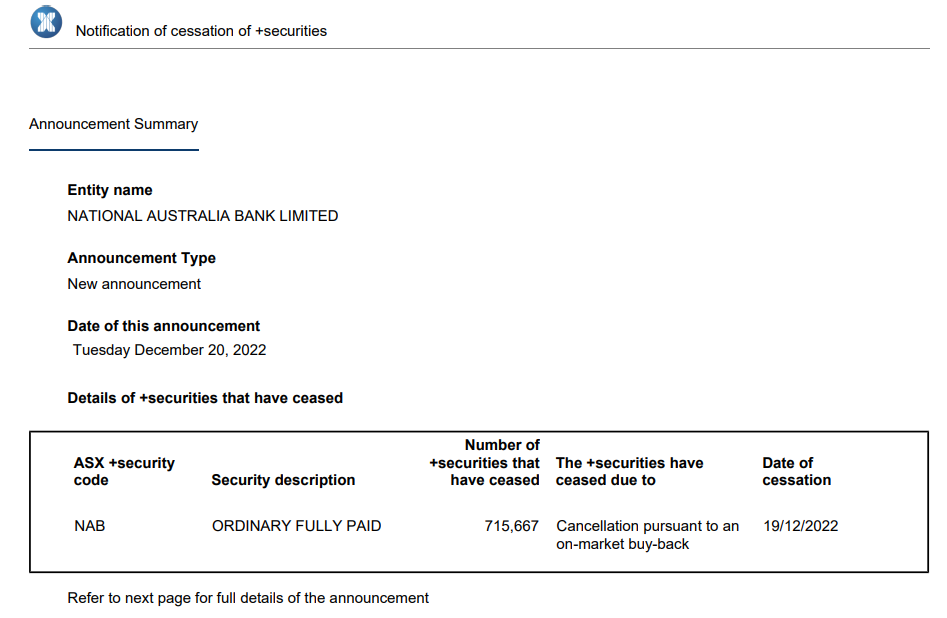

- Slice merging : Aside from treasury concentration, investee companies often will embark upon excess capital management by purchasing shares on market & simply cancelling those shares. Again, NAB did this with $5BN worth of excess capital (read “lazy cash”) in the 22FY. I have extracted one announcement below. This is done for many reasons, but the effect for the continuing shareholder and in particular for the dividend re-investor is to make each share in the company worth a smidgen more as you hold over time. As the number of slices into which the pie is cut decrease, the dividends paid on those shares will proportionately increase as will the share price.

So, there you have it. A summary of why and how dividend reinvestment works to deliver huge value to investors. Australian tax resident investors who do not get involved in this bonanza are acting illogically. This is particularly true in relation to our big banks which form a cartel and mutually reinforce each other’s profitability simply by existing as fail safes for one another. Far from accidental, this situation is in accordance with the Australian Federal Governments unofficial “4 pillars policy” which prevents the 4 from merging. Maybe its anticompetitive. However it has led to decades of stability and has also delivered the extraordinary result whereby our big 4 are among the largest and most stable banks in the whole world despite servicing a domestic population of only 30 million people (including NZ).

To discuss your situation and find out how dividend reinvesting can work for your family group, either inside or outside of super, contact Chris today at chris@solveaccounting.com.au

Avoiding confirmation bias

In recent times the world has witnessed the implosion of FTX. At the same time, Elizabeth Holmes, the once golden girl of tech valley, was sentenced to 11 years in federal prison for securities fraud. Meanwhile, in Eastern Europe, Vlad Putin is busy trying to force a whole sovereign country full of citizens to revert to Soviet style serfdom based on some twisted world view. What do these 3 disasters, along with the legion other examples you might be thinking of, all have in common? Well, as an illustration of my central point in this blog post, I would offer the following “golden thread”; having smoke blown up your arse is insidious and deadly.

Avoiding “arse smoke” and managing those who blow it is an important life skill and guiding principle. In psychology academic speak, it is called avoiding “confirmation bias”. Confirmation bias is the tendency of people and institutions to favour information or explanations which agree with and/or strengthen their existing views & practices. We could add that it also involves the tendency to reject the individuals and ideas who/which challenge, contradict or detract from one’s existing modus operandi. Fighting against it is an idea that should be encouraged to permeate throughout one’s entire life as much as possible. Only by keeping an open mind, asking good questions, and honestly listening to people’s answers can we evolve to a better understanding of the various markets in which we all operate.

In a commercial sense, market validation is the best way to avoid confirmation bias. Replacing “yes men” with honest people is the only way a business or idea or country can progress. Don’t ever believe hype – particularly your own. Always be humble and seek to learn more so that you may grow in knowledge and earnings. Be a constant student of whatever game you are playing and always try to guard against pride and ego. It’s important to remember that things are seldom ever as bad or as good as they seem, and to be measured & calculating in your response to everything. Acting with equanimity, patience and courtesy is the essence of personal quality. We should all strive to be higher quality people.

In that spirit, we should seek out and appreciate contrarians and try to listen to and learn from them. An educated and rational contrarian, one who acts with equanimity, is the ultimate antidote to wishful thinking. Good tax accountants apply their knowledge of the tax law to real world numbers to prospectively guide a client’s decisions to reach tax optimal outcomes. The job of honing and perfecting this skill is lifelong. With humility and a commitment to lifelong learning, a tax accountant becomes more useful to a client with every passing day. The opposite is also true.

To discuss your circumstances, call or email Chris today at chris@solveaccounting.com.au

In the investment universe, simplicity is king.

“Don’t put all your eggs in one basket” – unknown

Having been in the public practice of income tax compliance for close to 20 years now, I’m not so sure about this statement. Diversification belies deep complexity. To understand diversification, we need to define what that means because it means different things in different contexts. Our definition here is purchasing more than one security inside an SMSF. I’ve had to define narrowly here to get through this blog post in a small word count.

Owning multiple shares or assets inside a SMSF is increasingly unnecessary for the “true” investor. One important reason for this is the invention of the low cost, very broad based, computer managed index fund. In Australia, VAS is the leader in this field. Although staff are required to prepare tax statements, the ownership structure of Vanguard funds is circular such that the management company is owned by the fund which aligns unitholders with managers on both stability and cost. Specifically, Vanguard’s management company is ultimately owned by the investors so it will never be acquired and it also allows the manager to return profits to investors through lower costs. In summary, scale up = management fees as a % of assets managed down. This structure creates a self-reinforcing cycle of downward pressure on management costs and it is a welcome financial innovation.

Even putting low cost broad based index funds to the side, diversification is still questionable in a modern and well regulated economy and stock market like the ASX in Australia. Simply buying a share in the CBA for example exposes the shareholder to many different business lines e.g. insurance, super, business lending, project finance, mortgages etc, and the CBA’s revenue streams are also geographically diverse. There’s big non-monetary value in only having to watch one stock. You don’t have to keep track of 20 different holdings and you can accumulate deep understanding of your investee over time. Diversification wears investors down and eventually wears them out. Picking one horse also means that you don’t have to listen to as much twaddle from as many “analysts” shouting over each other to be heard as to what you should or shouldn’t do with your holdings. Picking a big profitable company with a sustainable moat like the CBA or Woolworths or any of the top 10-20 means that its highly unlikely to go bankrupt. The big 4 Aussie banks are oligopolistic monopolies or to put it simply, a cartel (politically protected profit machines). If any of the 4 go broke, the whole country will have much bigger problems than what’s happening to our super balances. In this context what’s wrong with putting all your eggs in one basket?

Advocating for a single holding portfolio is not the point of this blog post. However, it is worth considering for those who understand the value of simplicity in investment.

To discuss your circumstances, call or email Chris today at chris@solveaccounting.com.au

Invest individual, think institutional

“The individual investor should act consistently as an investor and not as a speculator.” – Benjamin Graham

This quote has been attributed to Ben Graham, but I’m not sure if its from TII… regardless, it’s both very true & worth analysis.

There are 4 key definitions in this statement which we need to dig into in order to understand the meaning in this quote:

- Individual. A lot of people think incorrectly about themselves. They perceive themselves as a “human being” as opposed to an institution. While this is correct in the physical universe in which we all live & breathe, in the parallel investment universe, the human / individual is simply another investment vehicle. It can borrow and invest money, hold assets and even run a business as a sole trader. Most people think to themselves “I’m just a small guy, a little fish….” They forget that ultimately, humans own or control everything. Viewing yourself as an investment vehicle expands your thinking about what you can actually achieve financially. Tracking your net worth on a simple Excel spreadsheet and regularly updating it to reflect changes in market conditions is a key financial skill every individual should practice to help them understand and gain insight into, and control of, their financial life.

- Investor. There is no such thing as a long term investor. An investor is a long term thinker & a long term actor by implication. To invest is to not speculate – the terms are mutually exclusive sitting as they do at opposite ends of the spectrum. Investors primarily make money from yield, earnings, dividends, distributions or income from assets. An investor will look to what the asset produces over time to assess its performance and value the asset in the first place. What is also of importance to an investor is the quality of those earnings. Earnings quality is determined by certain characteristics of the asset. In the case of productive land it is location (for rental properties) and output (for farms) that is the key competitive advantage. With shares in companies which derive their value from underlying businesses, it’s the moat surrounding that business in its respective market that is the key competitive advantage. Investors understand competitive advantage of different assets & for the most part will value the asset based on yield before considering the offer price.

- Consistently. The importance of this word cannot be overstated. If there is one personal quality that can lead to investment success, its consistency. Specifically, the consistent buying of high quality assets over time regardless of all market conditions – and dividend or distribution reinvestment if that facility is available. John Bogle was an advocate of this approach particularly with broad based index funds in the investors home currency & market. Home field advantage was a big thing to him. Discipline breeds consistency. Disciplined buying and disciplined re-investment over time can lead to extremely satisfactory investment returns. In Australia, the tax privileged individual who can think & invest in an institutional way is often the most successful type of investor.

- Speculator. A speculator is a person or other entity who seeks to sell something for more than what they paid for it. Speculation is the process which the speculator engages in. Speculation is different to trading. Trading is where the trader purchases items of trading stock (or inventory) to sell in the course of a business he or she or it is carrying on eg . There is nothing wrong with speculation in an open legitimate market. This approach absolutely has its place. Its only dangerous when people confuse speculation with investment. Its also very hard to consistently speculate profitably after fees, costs & taxes are taken into account. Speculative assets typically yield zero as they tend to sit on the other end of the yield-growth spectrum.

Maximising your after tax outcomes from investment or speculation requires timely, accurate & savvy tax advice. To discuss your circumstances, call or email Chris today at chris@solveaccounting.com.au

Attitude, not aptitude determines altitude: Embrace your place and celebrate the ordinary to win

“If you are not willing to risk the usual, you will have to settle for the ordinary.” – Jim Rohn

I strongly disagree with this statement. Specifically, I would counter that the ordinary can produce the extraordinary over time where sound reason is structured into a person’s financial life and bad calls are avoided with discipline. A healthy dose of perspective is also a key trait of successful but “ordinary” people.

There is no reason for the bulk majority of humans to seek anything other than a “normal” life. Particularly those of us fortunate enough to have won the genetic lottery of being born in a developed country with a functioning, legitimate system of public governance. Innovators can’t help themselves – its literally impossible for a true innovator to achieve anything other than superstardom (to the rest of us). To them, Microsoft or Apple or Google or Tesla is normal & usual & the logical, inevitable destination. It is also very interesting that many of the globally significant innovators tend to end up in the United States – as did Terrance Tao. Most of humanity will never be these people, and that’s ok. (a) they are all flawed & human despite their perceived achievement and (b), its not our place in our respective individual family chains to shine that bright – but we can still make our individual links as strong as possible for our split second of consciousness while we’re all passing through by being mindful and responsible custodians.

In direct contrast to the Rohn statement above, Ben Graham has said, “To achieve a satisfactory result is easier than most people realise; & to outperform is harder than it looks.” The Graham statement needs to be understood in context. It alludes to the reality that, no matter how well you go in any field of endeavour, there will always be someone outperforming you & its pointless to chase them. Instead of continually wishing for the grass in somebody else’s paddock, Graham is suggesting that we should each focus on the green patches on our own side of the fence. We should celebrate and nurture them. That attitude represents contentment, which is true success.

Wherever you are, give thanks to whoever your God is for every breath you’re allowed to take. & Whatever you are, be a good one.

118B & income taxing the main residence in Australia - is reform required?

It is clear that the various state, federal and even local governments have their eyes firmly fixed on the last great pool of untaxed assets held in Australia being the approximate $9TN worth of main residences which largely escape any form of taxation. For various reasons which I’ll outline below, the theory is good. BUT, and this is probably the biggest “BUT” in contemporary Australian tax law; no matter how much bureaucratic will there is to implement taxation of main residence assets, the political reality of it is hard…. that’s the last hurdle – political implementation.

Theory is one thing, implementation is entirely another universe. It’s the only roadblock really because the theory behind taxation is correct.

The policy logic reasons FOR taxing the main residence in Australia include:

- Equity – This is a big word. It encompasses a large amount of issues in this context. Just one simple example among many others might be the asset rich but low income “little old lady” living in a $20M Vaucluse mansion. She collects a full aged pension because the main residence is an excluded asset, paying pensioner discounted council and water rates, health care card medical costs, pensioner rate public transport, pensioner vehicle registration costs etc etc then, dies leaving a $30M tax exempt estate comprising solely of her main residence to her already wealthy adult children who have been subsidising her lifestyle in anticipation of the windfall gain. This is not fair, smart or sustainable.

- Flexibility – there’s any number of ways the tax law could be used to ease people into the mindset of taxation on the main residence. Grandfathering in the rules would ensure those who have purchased under the existing regime wont be affected or have many years to contemplate and deal with the impact of the changes. Imposing a lifetime threshold for 118-B CGT exemption equal to the transfer balance cap is another, as is the ability to contribute the proceeds into super in some concessionally taxed way. Such a sweeping reform would touch on many other areas of law, not just tax.

- Innovation – Australia’s taxation system, in fact its whole economic system, is geared towards land ownership. The concessions for main residence ownership and “game playing” are not sustainable, nor are they smart. Policy settings at the moment encourage particularly wealthier people to chase a trophy main residence CGT free windfall. It’s a pity that in Australia, people see homes & land as more of an investment or financial play instead of seeing a house for what it is, a place to live i.e. its either your home or someone else’s. Focusing people’s productive energy on innovation and business risk taking rather than spending most of their productive life paying down a mortgage is a change we should make.

There will be resistance & many counter arguments here as there always is to any reform. The complexities around calculating cost base of a main residence for CGT purposes are an obvious issue that will need to be addressed. Generationally resetting the Australian mindset on land, an inherently non changing and un-innovative asset, is a worthy cause to pursue.

To discuss your circumstances, email chris@solveaccounting.com.au

How to improve your year-end processes and plan for 2023

We're well into the final quarter of the year, with 2023 just a few months around the corner. But are you ready for the year-end? And have you done your homework when it comes to planning your business journey for 2023 and beyond?

Let's take a look at the key ways to tie up your year-end and start the new year with a clear strategy to drive your business forward.

Making your 2023 business journey that little bit easier

The past couple of years have not been easy for the average small business owner. Cashflow will have been tight, prices and costs have been steadily rising and the marketplace is ever-more competitive as we move into 2023.

So, what can you do to make your life easier for the coming year? And what checks should you be making as we wrap up this final quarter of 2022:

- Is your bookkeeping up-to-date? – make sure you've entered all the expenses, costs and receipts for this final Q4 period. And check that you’ve scanned all the documents and receipts that are needed to finalise the books and meet your compliance requirements. With everything uploaded and matched in your cloud accounting software, you’ll make the job of wrapping up your period-end accounts much easier.

- Have you invoiced out for all the work completed in this quarter? – look through your recent sales and projects to make sure that everything that should have been invoiced out has actually been billed. Work carried out in this period should be invoiced out in the same period, so your accounts and cashflow all tally and reconcile neatly.

- Do you have any outstanding supplier bills or customer payments? – check your accounts payable to make sure you've paid all your supplier bills and that there are no outstanding debts to pay. Also run an aged debtors report and see if there are any outstanding customer payments that have yet to be received. If you haven’t already, set up automated chaser emails for late payments, so you can start 2023 with the best possible credit control processes and accounts receivable performance.

- Have you set your key goals for 2023? – with your bookkeeping sorted, it's time to look forward to the new year. What are your aims for 2023 and how do you plan to achieve them? Set out your goals for the coming year and make sure you communicate these targets clearly to the whole business. When everyone is singing from the same hymn sheet, you make it easier to drive performance effectively.

- Do you have a business plan that's ready to implement? – put your goals and targets for the year into a detailed business plan. Set timelines, agree on budgets and make sure you're tracking progress against these – so you can see how well the business is performing. With the latest cloud tools and planning apps, you can get some amazing insights into your business journey and your overall return on investment (ROI).

Talk to us about kickstarting your 2023 planning

If you haven’t put much thought into your planning for the new year, don’t worry. We can help you tidy up the loose ends, set out your strategy and get everything into a workable plan.

2023 is likely to be a challenge for some sectors. But with your finances looking shipshape and a routemap for the year ahead, you’re ready to make next year a success story.

Business tips: Making the most of digital and cloud

Transforming into a digital business sets the best possible infrastructure for your future growth. And, as your business scales, the benefits of going digital will start to become obvious.

Running your key business processes in the cloud and using the latest digital software and apps adds to both your efficiency and your productivity. And, most importantly, digital systems are designed to scale with you as your enterprise grows and the need for resources increases.

Here are some of the big reasons for taking the plunge and diving into digital.

Automate your key manual process to increase efficiency

A scalable business has to systemise its processes and procedures. If your business model is still tied to manual processes and a system that only exists in the owner’s head, you’ll eventually come up against a capacity brick wall. Systemising and automating your processes is a fundamental step when you make the jump to digital.

Look at every internal and external step in your operations and write down how these systems work. Note down each task, who actions what and how the whole system links in with the next step in your operational chain. If there are opportunities to automate a step, automate it. Many business apps now include artificial intelligence (AI) or automation features that can chase up unpaid invoices, send automated replies to customers in live chats, or take automatic payments etc.

Work in the cloud to stay more connected

Since the start of the 2020 pandemic, the world has seen a quantum shift to remote working – and that’s only been possible because of cloud technology. Instead of working from local applications on our laptops or office-based servers, most tech-savvy businesses now use cloud-based apps that are accessible anywhere you have an internet connection.

Switching to cloud-based systems is a game-changer. You and your team are no longer tied to a physical office and can be productive from any WiFi-enabled location. That could be your home, your customer’s warehouse, your regional office or your local coffee shop. And the benefits aren’t just limited to remote working. With your applications and databases in the cloud, you can access customer information, sales data or financial numbers wherever you happen to be. Everything is securely backed up and available at the press of a button – that’s an invaluable benefit if you want to be flexible, connected and scalable as a business.

Create your own custom app stack

Your business systems and software no longer have to remain static and based on the office server. By combining a business and accounting platform like Xero, MYOB, QuickBooks or Sage with your own choice of business apps, you can create a truly tailored ‘app stack’.

Apps use an API (application programming interface) to connect with each other, share data and form a larger business system. This can include apps to:

- Manage and automate your bookkeeping and accounting tasks

- Send out e-invoices to your customers to speed up payments

- Take automated payments and reconcile your transactions

- Automatically chase late-paying customers and carry out credit control duties

- Project manage your operations and provide detailed reporting

- Manage your job utilisation and time spend on each project

- Keep a detailed real-time inventory of your products

- Send out marketing campaigns and social media posts to your audience

- Interact more closely with your end customers and learn their habits

Record and track your business data

App integrations and a customer app stack don’t just improve your productivity. Because your apps are connected via APIs and are sharing your business data, you also have access to a wealth of data, information and reporting features.

Look in detail at your cashflow, expenses and spending to improve your cash position. Take a deep dive into your sales and marketing information to find out who your best (and most profitable) customers are. Run projections and ‘What if…’ scenarios, based on your historical data to forecast the future path of the business. There are plenty of ways to make use of this bountiful data to help you review, understand and improve your performance as a company.

Make better-informed business decisions

A business in the pre-computer age would have had very little information on which to base its decision-making. Annual accounts, cashflow statements and some basic management information would have been available, but there was very little real-time data to refer to.

In the digital age, you can literally see every aspect of your company’s performance in real-time – and, in some cases, in the future as well. That’s a game-changer in so many ways, and something every business owner should be using to improve strategy, financial management, customer experience and business decision-making.

To summarise, a digital business:

- Creates systems that are integrated and connected

- Shares and records all your business data

- Reviews, analyses and finds insights in your business information

- Connects with your customers in more meaningful ways

- Makes better-informed business decisions, as a result.